Daily Outlook: Crypto Market Before New York Open

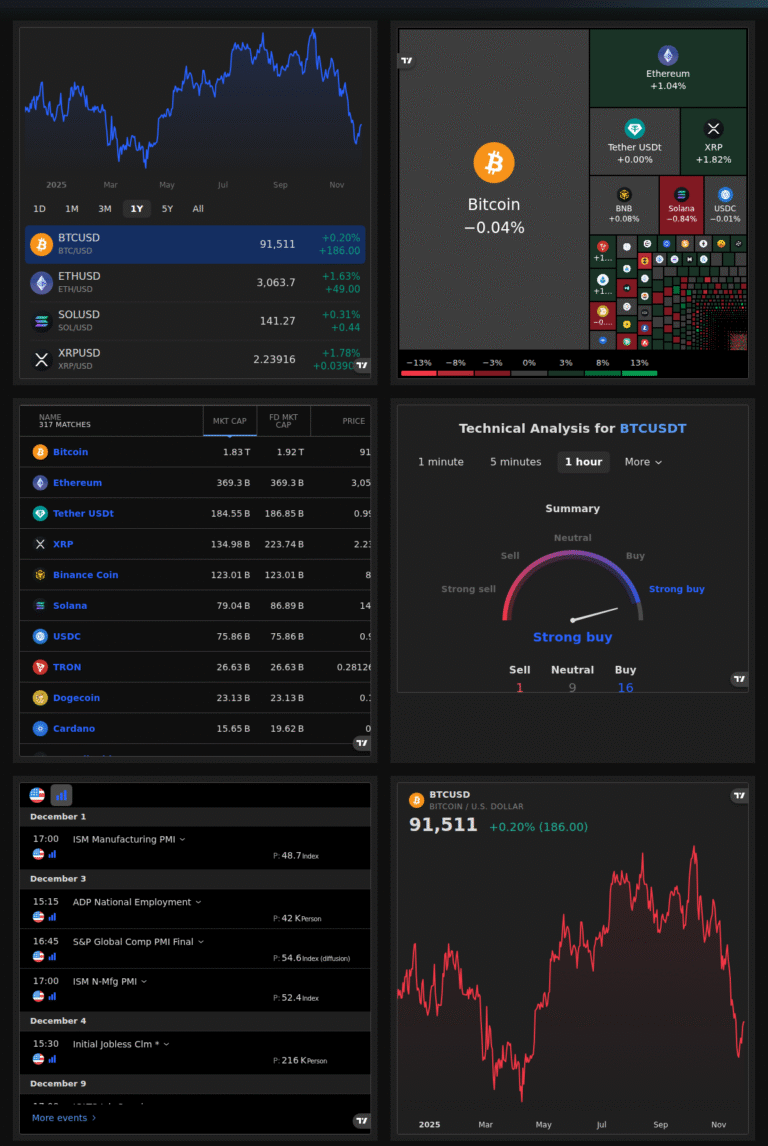

The crypto market is set to enter the New York trading session with Bitcoin near $95k and Ethereum around $3.1k. The market breadth remains strong, but sentiment is neutral.

Discover the latest trading guides, in-depth market analysis, and practical crypto tips.

Stay ahead with daily updates from the WaveFibs analyst team.

The crypto market is set to enter the New York trading session with Bitcoin near $95k and Ethereum around $3.1k. The market breadth remains strong, but sentiment is neutral.

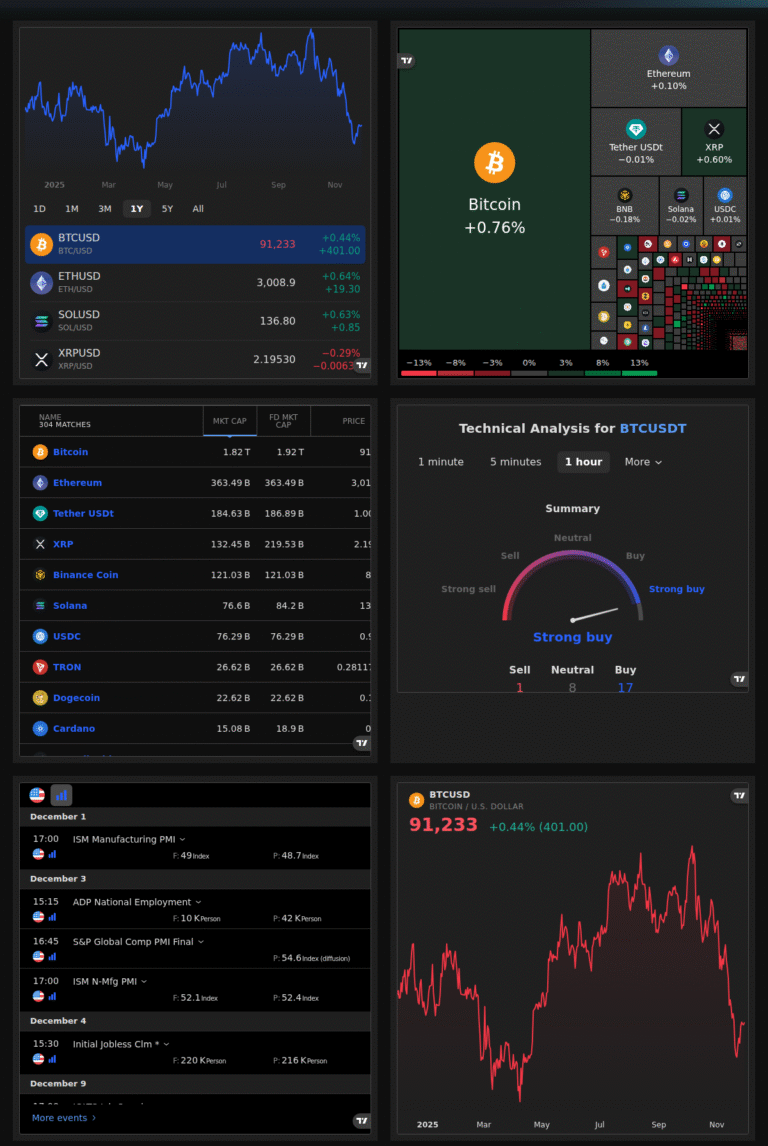

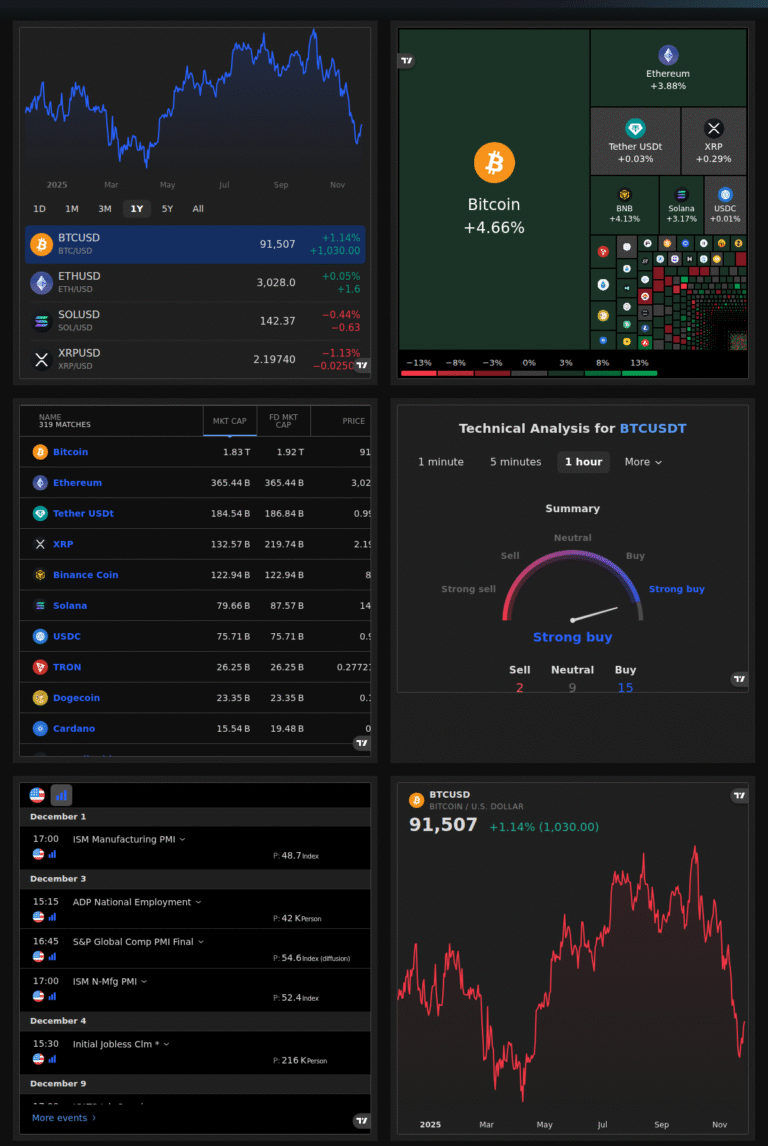

The crypto market remains in a state of fear, with BTC near $91k and ETH around $3k. This outlook examines the current market conditions and provides actionable takeaways for traders.

Cryptocurrency Market Volatility Introduction Introduction Introduction The cryptocurrency market continues to navigate through a complex landscape influenced by macroeconomic trends, regulatory changes, and investor sentiment. This update provides an overview of the latest developments, focusing on Bitcoin (BTC) and Ethereum…

Crypto Markets Amidst Airline Turmoil The crypto markets continue to navigate through a mix of economic, technological, and social factors. This week’s highlights include significant developments in the airline industry, positive stock market performance, and notable movements in the tech…

The crypto market is in a state of extreme fear as we approach the New York trading session. Bitcoin (BTC) is near $91k, while Ethereum (ETH) is around $3k. The market cap stands at $3.29 trillion, with a 24-hour volume of $489 billion.

Cryptocurrency Market Dynamics The cryptocurrency market continues to navigate through various economic pressures and uncertainties. As of November 27, 2025, Bitcoin (BTC) is trading at approximately $90,797. This update provides an overview of recent market dynamics and explores potential scenarios…

The crypto market is experiencing extreme fear as traders prepare for the New York trading session. BTC near $91k, ETH around $3k, with USDT leading in trading volume.

Cryptocurrency Market Stability Amid Economic Uncertainty The cryptocurrency market continues to evolve, influenced by various factors such as economic trends, technological advancements, and regulatory changes. As of November 27, 2025, Bitcoin (BTC) is trading at $91,343. This update provides insights…

WaveFibs publishes new guides, trading research, and market insights every day. Subscribe or join our Telegram to get instant updates.

Our quantitative analysts and AI stack collaborate on every post—combining expert market experience with large language models and rigorous manual review.

Yes. Our step-by-step guides and FAQs are written for both beginners and advanced traders, focusing on clarity, transparency, and actionable value.

Yes—core content and signals are free. We may introduce premium analytics in the future, but most resources are open-access for all traders.

Contact us via Telegram, our web form, or email: [email protected]

Engaging with crypto analysis, signals, or market guides on WaveFibs.com involves a high level of risk. The crypto market is volatile—prices can move rapidly and unpredictably.

All content, tools, and trading signals are for educational purposes only. WaveFibs does not provide investment advice, portfolio management, or individualized financial recommendations.