Dayli Outlook: Crypto Market Before New York Open

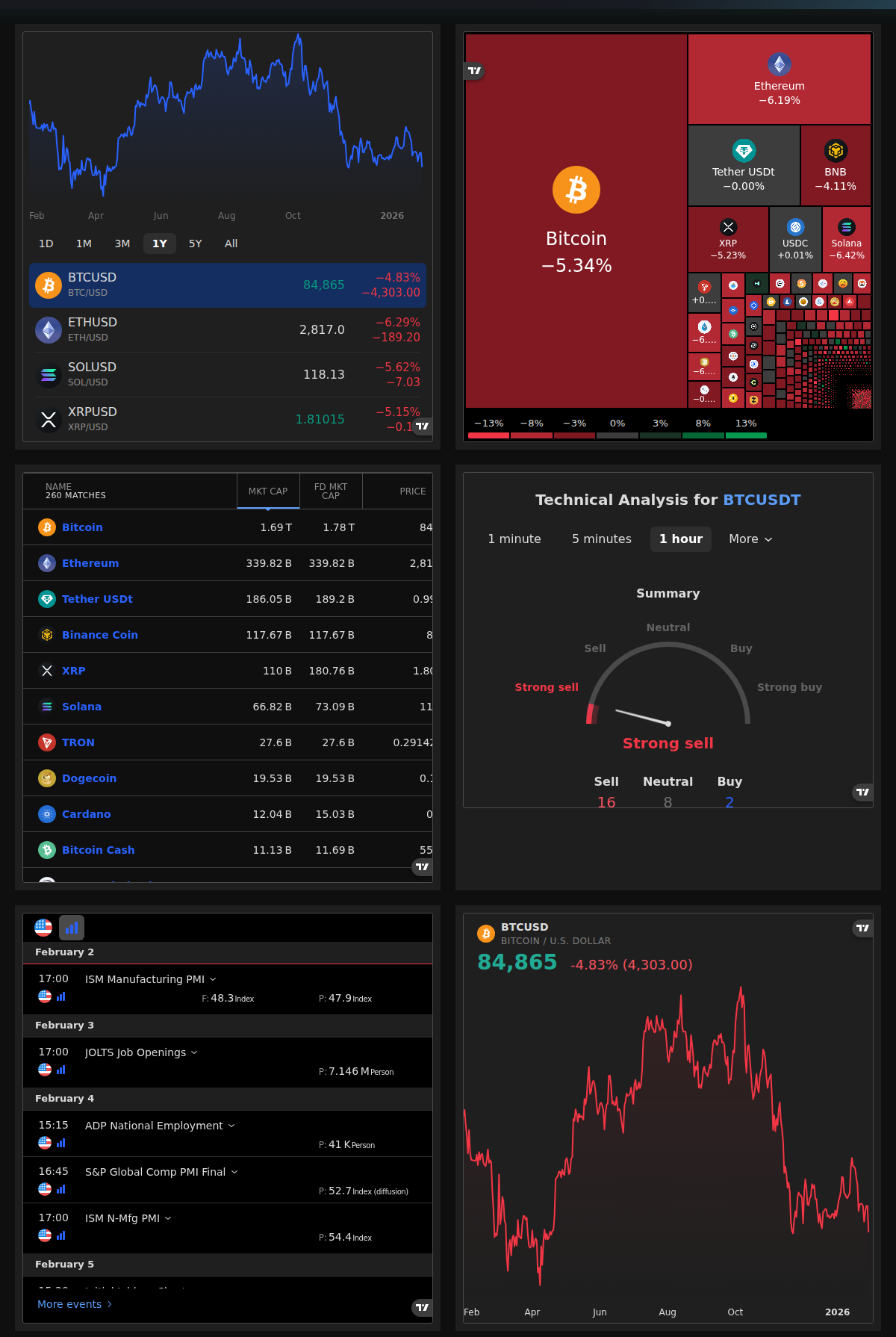

The crypto market is showing signs of weakness with BTC near $84.7k and ETH around $2.8k. Fear dominates the sentiment index, with top gainers concentrated in obscure tokens.

The upcoming New York trading session will see the crypto market with BTC near $84.7k and ETH around $2.8k. The market cap stands at approximately $2.96 trillion, while the 24-hour trading volume is $65.5 billion. Fear currently dominates the sentiment index, with a score of 26, indicating extreme fear.

Introduction

The crypto market is entering the New York trading session with BTC near $84.7k and ETH around $2.8k. The market cap is approximately $2.96 trillion, while the 24-hour trading volume is $65.5 billion. Fear currently dominates the sentiment index, with a score of 26, indicating extreme fear.

Market Drivers

The current market breadth and liquidity are relatively low, with active currencies at 4,790 and active markets at 46,844. The BTC dominance is 57.09%, and ETH dominance is 11.46%. This suggests that the market is heavily concentrated around BTC and ETH, with limited diversification among other altcoins.

In terms of sentiment, the fear and greed index stands at 26, indicating extreme fear. This level of fear can often lead to increased volatility and potential selling pressure, especially in the wake of recent regulatory news and macroeconomic concerns.

Scenarios

Base Scenario

In the base scenario, BTC and ETH are expected to consolidate within their current ranges, with BTC near $84.7k and ETH around $2.8k. The market may experience some volatility due to the high fear levels, but a significant breakout is less likely in the short term.

Bull Scenario

In the bull scenario, a sudden shift in sentiment could push BTC and ETH higher. A drop in the fear and greed index to more neutral levels could signal a buying opportunity, potentially leading to a rally in both BTC and ETH.

Bear Scenario

In the bear scenario, continued extreme fear could lead to further selling pressure, pushing BTC and ETH lower. A sustained drop in the fear and greed index to extremely low levels could indicate a broader market sell-off.

Risks & Invalidation

The main risks include a sudden shift in sentiment, regulatory changes, or macroeconomic events that could impact the market’s risk appetite. A significant drop in the fear and greed index to extremely low levels could invalidate the base scenario, shifting the market towards a more bearish outlook.

Actionable Takeaways

Traders should monitor the fear and greed index closely, as well as any regulatory updates or macroeconomic news that could impact the market. Positioning should be cautious, with an eye on consolidating ranges for BTC and ETH.